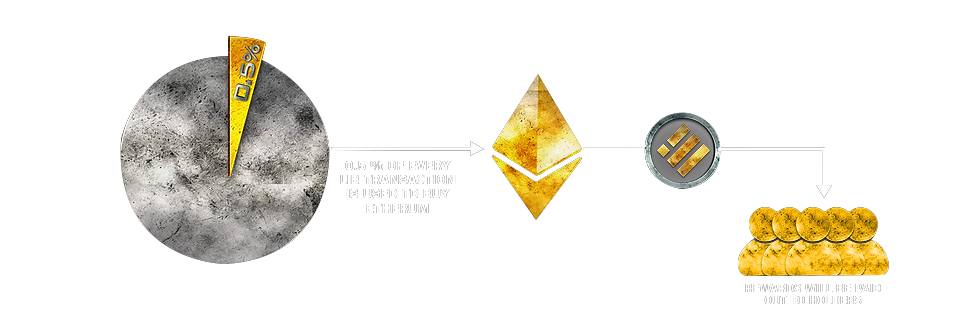

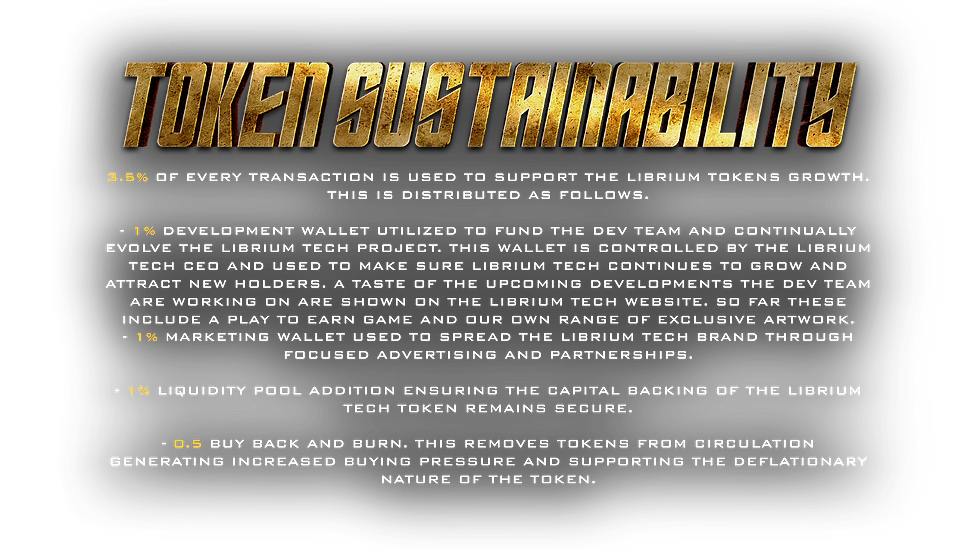

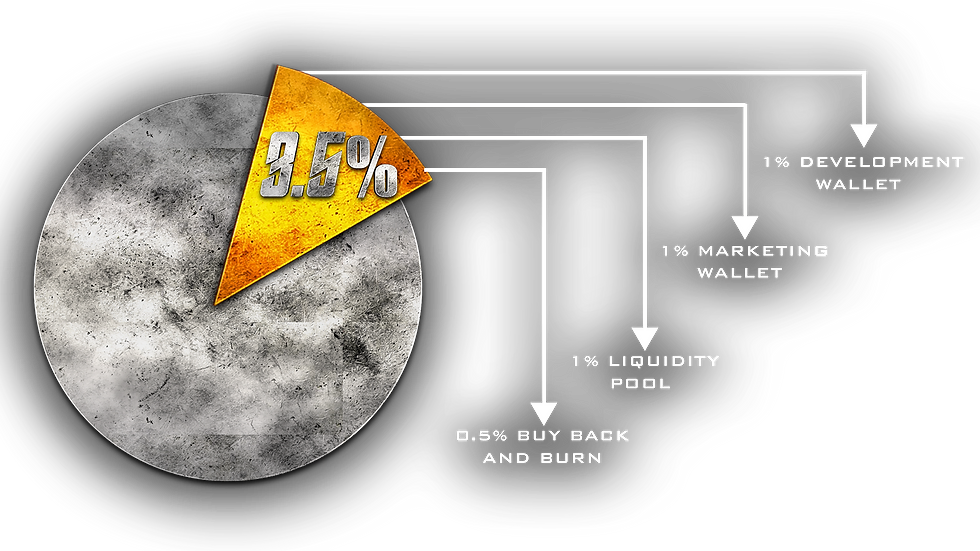

THIS MEANS IF YOU BOUGHT 10,000 LIBRIUM TECH TOKENS YOU WOULD RECEIVE 8,800 TOKEN AND THE REMAINING 1,200 TOKENS ARE REINVESTED INTO THE PROJECT. IF YOU THINK THIS SOUNDS LIKE A STEEP PRICE TO PAY, KEEP READING TO FIND OUT WHY THIS SLIPPAGE WILL HELP YOU GROW YOUR INITIAL INVESTMENT.